Trajectory #14: The Covid-19 Pandemic

A Selection of critical stories on the Covid-19 Pandemic of 2020

Hey there,

It’s Mikal Khoso and welcome to Trajectory, a newsletter about where the world is heading, delivered straight to your inbox. In case you didn’t notice, we’ve rebranded! Adios to Ceteris Paribus and hello to Trajectory! This name better captures the topics and content I aim to write about. Thanks for being a subscriber!

The High-Level This Week: This is a truly extraordinary moment in history. Thanks to a global pandemic for the first time ever the world is demobilizing and shutting down societies and economies worldwide. From Asia through Europe and the Americas people are being asked to stay home, businesses are being shut down and people are losing their jobs. This crisis will be remembered not only for the scale of the shutdowns it triggered but the speed at which if moved. In just 3 months the entire axis of the world has shifted and we are hurtling towards a recession of potentially gigantic proportions.

Instead of a full-length piece, this week I’ve decided to link to and briefly cover a range of different stories that touch on the many nuances of our current crisis.

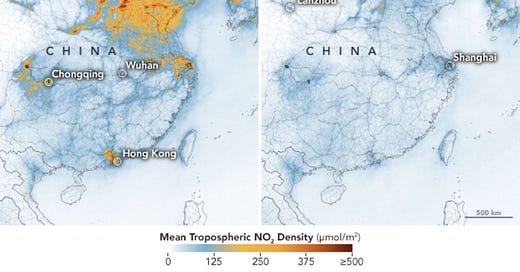

Air Pollution Vanishes Across China’s Industrial Heartland

China’s lockdown profoundly improved air quality across the country. While this will be temporary, the same effect has also been observed in other countries in lockdown such as Italy.

Impact of non-pharmaceutical interventions (NPIs) to reduce COVID19 mortality and healthcare demand

A paper from Imperial College London’s Disease and Emergency Analytics department models different scenarios for how Covid-19 might progress in the United States. The absolute worst case scenario is the do nothing scenario, which will result in almost 4 million deaths in the United States. The best case scenario? 1 million deaths. That’s terrifying. Read the paper as it is very thorough, but you can read a response to this paper arguing its models are flawed here written by the likes of Nassim Taleb.

How To Structure the Coronavirus Bailout

Matt Stoller runs one of my favorite newsletters and he commented this week on how best to structure the impending industry bailouts that the US government is putting together. 2008-9 saw gigantic bailouts of the financial industry via the Troubled Asset Relief Program (TARP) as well as several other assistance programs including the $787 billion American Recovery and Reinvestment Act (ARRA) of 2009.

However, no bankers were punished and jailed for their illegal actions and bankers got off scot-free resulting in something economists call moral hazard as well as volcanic public fury and Occupy Wall Street (if you remember that). Matt walks through a series of proposals on how to do things better this time including limitations on share buybacks, dividends and the like.

Senate GOP crafting new massive coronavirus package at 'warp speed'

The US government is about to financially intervene in the US economy in a way that makes the $700 billion TARP and $787 billion ARRA programs in 2008 look like child’s play. The US Senate is actively considering bills to launch a one-time universal basic income credit of $1000 for qualifying Americans, bailout the airline industry, billions in loans to protect small businesses and payroll tax holidays to alleviate the pressure. This is separate from the massive injections of money ($700 billion to start) the US Federal reserve is pumping into the economy (next).

The Fed Fires ‘The Big One’

If for nothing else this moment will go down in monetary history because of the Federal Reserve’s incredible actions. Modern banking is based around the concept of fractional reserve banking, where basically banks are able to lend out money they don’t really physically have in order to “create money” and accelerate economic growth. As part of this fractional reserve banking system, banks have a “reserve ratio” that the Federal Reserve determines. This is the amount of actual money they need to have on hand relative to the total value of their loan portfolio, historically sitting somewhere between 10-20%.

The Reserve Ratio has been a foundational piece of the US banking system. The Federal Reserve just eliminated it. Banks can now lend out any amount of money without be required to maintain a certain ratio of physical assets on hand. In the 100+ year history of the Federal Reserve this has never happened.

High Temperature and High Humidity Reduce the Transmission of COVID-19

Finally, some good news. Early research is showing that high temperatures and humidity slow the spread of the coronavirus. The R0 (pronounced R naught) is a metric epidemiologists use to measure how fast viruses spread. An R0 of 1 means each infected person infects one other person. Covid-19 is thought to have an R0 between 1.5-3.5.

More young people are being admitted to hospital in Italy with coronavirus, as the outbreak continues

As the pandemic progresses around the world the average age of those hospitalized and dying is dropping. This is worrying news. This is happening because older people have weaker immune systems and tend to die quicker than younger people. As time passes, younger people see their disease progress and unfortunately a growing proportion are dying.

Trump Says He’s Invoking Defense Production Act for Coronavirus

The US Defense Production Act was passed in 1950 in response to the start of the Korean War. The act gives the US government the power to mobilize the US private sector, requisition resources and to control the civilian economy for the purposes of national defense. By invoking the Act the US government now has the power to use the resources and productive capacity of the private sector to create medicine, masks and ventilators at scale.

China Announces That It Will Expel American Journalists

Chinese officials have started peddling a conspiracy theory that Covid-19 originated in the US and even that it’s a biological weapon developed by the US military. In response the US government summoned the Chinese ambassador and has started calling Covid-19 the “Wuhan Virus” or “Chinese Virus” in public. Today China took the extraordinary step of expelling US journalists from the NY Times, Washington Post and Wall Street Journal and barring them from working in the country. This is a dramatic escalation. There is definitely going to be more to come here.

Coronavirus is slowing down, end of pandemic is near: Israeli biophysicist

Stanford Professor and Nobel Laureate Michael Levitt is forecasting that Covid-19 will burn out relatively soon. How? He simply crunched the numbers.

REINVESTING WHEN TERRIFIED

A seminal piece from GMO - an asset manager - published on March 10th 2009 during the depths of the Great Recession. This short piece talks about how and why you should reinvest even when it feels like the sky is falling.

We are in a severe recession. What now for both companies and investors?

We have seen the most profound deceleration and demobilization of economic activity potentially ever. To quote my father - the world economy has hit pause. Countries are lockdown, bars and restaurants are closed, planes are empty and people are losing their jobs. In Madrid alone electricity consumption— a reasonable proxy for economic activity — is apparently down 30%. What does this profound and severe economic slowdown mean for companies, people and investors? This piece is the best I’ve read on this topic.

Moderna Announces First Participant Dosed in NIH-led Phase 1 Study of mRNA Vaccine (mRNA-1273) Against Novel Coronavirus

We’ll end with some more good news. Moderna Health has launched a phase 1 trial of a possible Coronavirus vaccine in the United States. This is the fastest turnaround of a vaccine trial in history.