Hey there,

It’s Mikal Khoso and welcome to Trajectory, a newsletter about where the world is heading, delivered straight to your inbox.

The High-Level This Week: A total economic lockdown is a nightmare scenario for small businesses that many will not survive. Every additional week of lockdown pushes millions more Americans into unemployment and thousands of small businesses closer to bankruptcy. The mass bankruptcy of small businesses will have profound consequences for years to come.

To learn more, read on.

If you haven’t already, subscribe here. If you liked this week’s edition and think someone else you know would find it interesting please take a couple seconds to share it via email or on social media.

Intellectual Sparks

The Dismantled State Takes on a Pandemic: The American Conservative movement has long been defined by an increasingly brazen commitment to “small government” and limiting the size and scale of the Federal government. This article walks through what a dismantled state facing a national crisis looks like.

Coronavirus Ushers in the Globalization We Were Afraid Of: The global order has been fragmenting for well over a decade. The Covid-19 pandemic may be the tipping point that shifts us into a new more unstable and disunited global order.

Choose Growth: Maslow’s Hierarchy of needs is widely quoted but poorly understand. This article breaks down what Maslow believed with nuance and perspective.

Roundup of Saudi Royals Expands With Detention of a 4th Prince: Do these latest detentions indicate that Crown Prince Mohammed Bin Salman is quietly preparing to ascend to the throne?

Key Issue: The Perfect Storm for Small Businesses

The Covid-19 pandemic has turned the world upside in a matter of weeks. Over a third of the world population is under lockdown, economies are in freefall and the disease continues to spread. The size and scale of this disruption is unlike anything we have seen in decades, and the depth, severity and speed of this recession is perhaps unlike any other recession we have previously experienced.

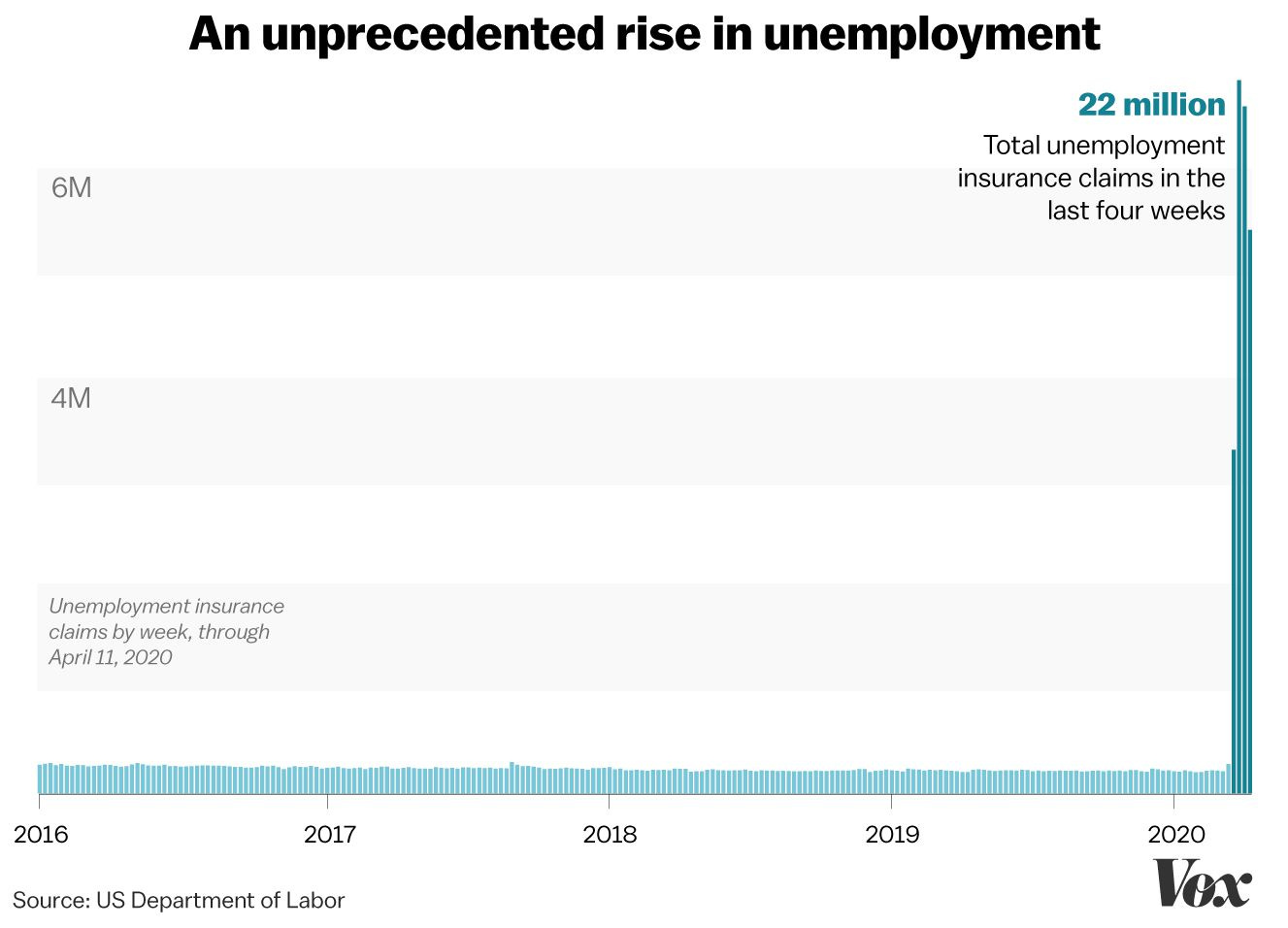

In just over one month 30 million Americans have filed unemployment claims, an astonishing figure. In comparison, 8.7 million Americans lost their jobs during the entire Great Recession 0f 2007 - 2009. The current lockdown and the economic crisis it is creating are likely to be especially painful for small businesses in America.

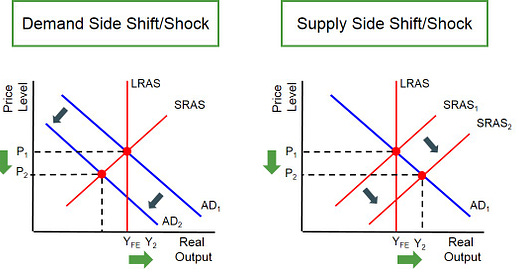

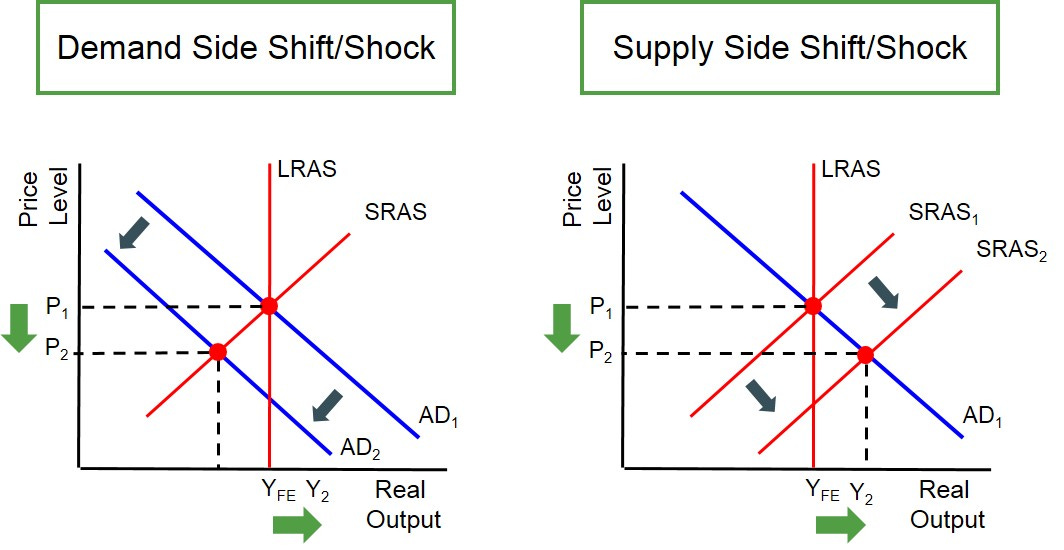

Demand-Side Shock!

The line that has been continuously repeated by pundits, politicians and news anchors alike is that this crisis is a “demand-side shock” to the economy. Demand and supply are the foundations of economic understanding. A “demand-side shock” is a sharp increase or decrease in overall demand in the economy, demand for things like restaurant meals, airline trips as well as things like raw materials.

The pundits are right - this is a significant negative demand-side shock to the global economy. In fact, it is a profound demand-side shock to some sectors that are essentially completely shutdown such as travel, tourism and entertainment. Pundits share this line as good news - “this is a demand-side shock to the economy, not a structural problem.” In their eyes, once the lockdown ends the economic engine will restart and snap back to its previous level (a so-called V-shaped recovery). A structural problem in the economy on the other hand is much harder to solve and involves deep problems in one or more specific sectors of the economy, such as the significant overleveraging of the financial sector which triggered the Great Recession.

A Structural Problem in the Economy

However, the longer the economy is in lockdown the higher the chance our current economic crisis evolves from a demand-side shock to a structural problem in the economy. This structural problem is most likely to emerge in the small business sector of the economy. Small businesses are, as their name describes, small and have limited resources. According to the American Chamber of Commerce there are 30.2 million small businesses in America of which 22 million have only one employee (also known as sole proprietorships). This leaves about 8 million businesses that employ more than one person nationally.

Running a small business is a tough job and profit margins are usually narrow. Small businesses have limited reserves of capital to weather any kind of disruption, let alone the magnitude of the one we are experiencing now. For many small businesses demand and as a consequence their revenue has gone to 0 (think restaurants, bars, hair salons). However, these businesses still have expenses to maintain such as rent, salaries and repaying any loans they have taken.

Saving Small Businesses

Every week of lockdown chips away at the limited reserves of capital these small businesses have. A long lockdown risks creating a significant structural problem in the economy - mass bankruptcies of small businesses. These businesses are the foundation of the American economy and employ the majority of the workforce. In fact, 99.9% of American businesses are small businesses (have under 500 employees).

Small businesses are very difficult to replace when they disappear. Small business owners usually get started by taking out a personal loan, a business loan or loans from friends and family. These three types of debt are going to be incredibly difficult to secure for anyone trying to start a small business in the aftermath of this crisis. According to the American Chamber of Commerce between 2009-2016 the annual rate of new small business creation was about 400,000 a year. If 1 million small businesses go out of business due to the current lockdown, then it could take 2.5 years just to replace them at normal rates.

The American Government must act boldly to stave off mass bankruptcies of small businesses. The Coronavirus Aid, Relief and Economic Security (CARES) Act which was negotiated and signed into law at light speed in March allocated hundreds of billions to the Paycheck Protection Program to give small businesses forgivable loans in exchange for keeping their employees on payroll. In just 6 weeks $660 billion has been lent out to over 3 million businesses across the nation. The PPP has been an incredible feat of government mobilization and public-private sector cooperation. However, it is not enough.

The Government must take further actions. Some of the following are worth considering:

Rent Freezes: Rent is a major expense for most small businesses, especially those that operate on high streets or in malls. The government should explore creating a structured program to freeze rent for small businesses in regions under lockdown. A 3, 6 or 9 month rent freeze would give businesses important breathing room.

Payroll Tax Holiday: This would eliminate all social security and medicare taxes for businesses for a given period of time and reduce their expenses.

Continued Paycheck Support: The Paycheck Protection Program only covers about 2.5 months of salary for all employees for recipients of the program. Extending this program will protect employment across the economy and ensure businesses are intact and ready to open when the economy reopens.

Mandated Grace Periods for Loan Repayments: American businesses and individuals are heavily indebted across many types of debt. The economic shutdown means the flow of money that services much of this debt is drying up. This is creating a ticking timebomb that needs to be directly addressed. Government legislation to create a “holiday period” or ease loan repayment timelines for a 6-12 month period would reduce the pressure in the system.

Back to Business Work Credits: Senator Hawley of Missouri has proposed giving small businesses who retain their employees during this crisis investment credits when the economy reopens to jumpstart their reopening process.

These are a few possibilities for how the US government and others worldwide can act boldly and swiftly to avert mass bankruptcies of small businesses. Small businesses are the lifeline of many communities and represent intergenerational wealth for many families. Their mass disappearance will not go quietly and the long-term pain it will create will be profound. The price of further inaction risks deepening the severity of our current economic crisis and lengthening the recovery significantly.