Trajectory #20: Global Money Laundering Part I

How dirty money moves across the Global Financial System

Welcome to new subscribers. To those just joining us, Trajectory explores where the world is heading and the trends determining our future, delivered straight to your inbox. To learn more about the editor Mikal - click here.

The High-Level This Week: It has been an open secret for some time that the global financial system is awash with dirty money. The recent leaks of the FinCEN files illustrates this problem in detail. Despite efforts to strengthen financial security and anti-money laundering safeguards, dirty money flows in the financial system continue to worsen. This two-part series will delve into the problem about money laundering and what can be done about it. You can read part two here.

Read on and share your thoughts in the comments below!

This Week in Data

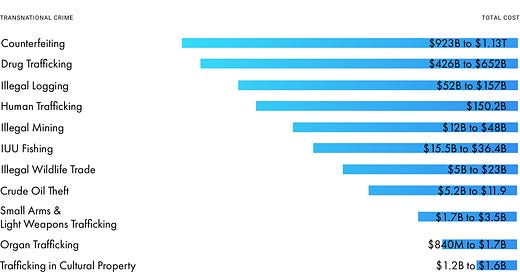

This great graphic from Revolut details the amount of money produced by different illicit activites globally and the figures are staggering.

Graphic from Revolut.

Intellectual Sparks

Massive genetic study shows coronavirus mutating and potentially evolving amid rapid U.S. spread: A sign of things to come?

Hate Speech on Facebook Is Pushing Ethiopia Dangerously Close to a Genocide: Not the first, and sadly not the most egregious example of Facebook amplifying violence on the ground

Which Party Represents the Racial Future?: Are Democrats really the party of the coming diverse American majority? Perhaps not.

Rallying to Protect Admissions Standards at America’s Best Public High School: The faultlines of American politics have now reached schools.

DOJ to Seek Congressional Curbs on Immunity for Internet Companies: A hugely significant potential shift in how content from internet companies is legally treated.

The growing case for an independent Western Cape: Separatism is all the rage these days, here’s one example that gets very little global coverage.

Editor’s Letter: Global Money Laundering and the FinCEN Files

The NY Times story shedding light on the mystery of US President Donald Trump’s tax returns has brought the issue of tax evasion and money laundering back into the limelight in recent weeks. According the NY Times, the President has avoided paying Federal income taxes in 10 of the 15 years preceding his election. Perhaps more politically damaging are the revelations that the President has paid as little as $750 (in the 2017 tax year) in years where he has paid income taxes. In comparison, in the same year the President paid taxes of $15,598 in Panama, $145,400 in India and $156,824 in the Philippines.

Despite the outrage in American politics, President Trump is far from alone in being creative with his taxes. Rather, the former businessman turned President is part of wider global trend of tax evasion by much of the global financial and political elite. About the same time that the news of Trump tax returns broke, the Financial Crimes Enforcement Network (FinCEN) of the US Treasury saw 2,100 files leaked from its servers. These files - now being dubbed the “FinCEN files” - include information on $2 trillion in transactions dated from 1999 to 2017 that had been flagged by banks as suspicious. The revelations in the FinCEN files are incendiary:

Several underworld figures are flagged as having received $10 billion in illicit funds laundered out of Russia through shell companies engaged in carefully choreographed stock deals, known as “mirror trades.”

Deutsche Bank, HSBC, Standard Chartered and Barclays Bank are among the major global banks that have helped facilitate suspicious transactions according to the leaks

HSBC is being accused of repeatedly moving money for a ponzi scheme, despite warning authorities that the funds were likely to be proceeds of a crime

Standard Chartered Bank processed almost $12m (£9.4m) in payments for Jordan's Arab Bank from 2014 to 2016. Standard Chartered later flagged more than 900 of these transactions that it suspected might have been for "illicit activities under the guise of charity" and “related to terrorist financing”

The scale of the laundering is immense. A small, obscure Czech bank ExpoBank has alone processed at least $29 billion in suspicious transactions for its customers.

Bank of New York Mellon flagged $7.1 billion in suspicious transactions that had flowed through Latvia’s Regional Investment Bank between 2006 and 2015.

Latvia has been flagged as a major originator of global money laundering flows. Embarrassingly, much of this laundering started when Valdis Dombrovskis was prime minister. He now serves as the European Union’s anti-money laundering chief.

These revelations are just a small selection of the revelations to come as reporters dig through the files. These FinCEN files are particularly information-rich and revealing because they are “Suspicious Action Reports” (SARs). In the United States, when a bank spots what it thinks is a suspicious transaction it files a SAR and submits it to FinCEN. These SARs contain the basic information on the parties involved in the transaction, details on the transaction and a short explanation from the bank on why it thinks the transaction is suspicious. Over 2 million SARs are filed annually by financial institutions in the United States. The FinCEN files are a leak of just 2,100 of the 12 million SARs received by FinCEN since 2011.

This leak shows that the international financial system is rife with dirty money and that FinCEN and the SAR process are failing to adequately cut down on global money laundering. In particular the leaks illustrate several critical flaws in the current process:

Banks often file SARs months after transaction takes place

Banks sometimes file multiple SARs on the same client without any punitive action being taken

US regulators have handed out $30b in fines since 2008 and yet some of the fined banks appear in the leaked files and are failing to do enough to crackdown on money laundering

These flaws in the SAR process are only getting worse. Since 2003 the number of SARs filed has quadrupled and the rate of growth is increasing. The number of SARs filed grew a dramatic 40% in just five years from 2014 to 2019.

The steep rise in SARs being filed has not been matched by rapid growth in the budget for the Treasury’s FinCEN unit. Since 2001, FinCEN’s staffing has increased from 178 to 300 - an increase of about 70% while the number of SARs filed have more than quadrupled. This is putting increasing strain on each employee, and the number of SARs per FinCEN employee has tripled to just under 4,000 as of 2019.

Chart from Brookings

The FinCEN files clearly illustrate how the global financial system is awash with dirty money and the mechanisms in place to crackdown on dirty money are inadequate and under increasing strain. Indeed, Linda A. Lacewell - the superintendent of the New York State Department of Financial Services - stated in a recent opinion piece that:

“Insiders have known for decades that the financial system is awash with trillions of dollars in dirty money running through the system.”

“The suspicious activity report — originally intended to alert law enforcement to potentially criminal activity — has become a free pass for banks. The report itself is frequently riddled with the names of anonymous shell companies that make it practically impossible to determine the identity of the perpetrators.”

Despite significant technological advances in the areas of machine learning and identity verification, global anti-money laundering efforts seem to be lagging behind the curve. Worse still, many global banks are actively aiding and abetting money laundering even after receiving fines from regulators for doing so.

In next week’s edition of Trajectory we will continue digging into global money laundering by delving into the Panama Papers leaks, discuss the problem of anonymous shell companies in more detail and walkthrough some concrete proposals on the table in the United States Congress to strengthen global financial security and anti-money laundering safeguards.

Read part two of this series here.

Great start. Looking forward to Trajectory 21!